There is information about checking your tax code on the Govuk website at httpswwwgovuktax-codeswhat-your-paye-coding-notice-means. Access the new tax code in PAYE Online in tax code notices the PAYE Desktop.

Hmrc Employee Paye Code Changes Sage Accounts Solutions

How do I claim a refund for the current tax year if I dont want to wait for a P800.

How To Get Paye Coding Notice. You owe less than 3000 on your tax bill. The P2 notice of coding provides an explanation of what your current tax code is and the reason as to why you have that tax code. If you are just on a standard personal allowance code 1250L for 201920 and 202021 tax years you probably will not.

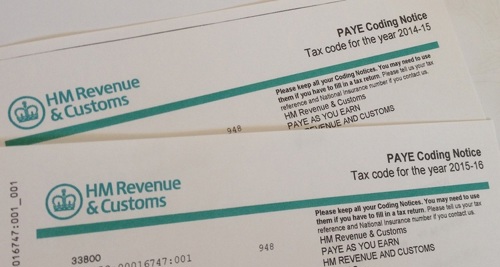

Send you a PAYE coding notice a form P2 if they are required to do so showing you how they have worked out your tax code. It sets out how much tax your employer will deduct from your wages in the coming tax year. The PAYE coding notice P2 is the letter HMRC send you telling you how the code number has been calculated.

Not everyone gets a letter. Indicates required information. HM Revenue and Customs HMRC will tell them which code to use.

Even so remember that the due date for the payment of tax is 31 January following the year of assessment and indeed that you can refuse to have other income included in your tax code ie you are allowed - within the rules - to minimise the amount paid monthly via PAYE so provided the tax due is paid by the due date there is no question of potential lost revenue on which a penalty could. How do I get my PAYE coding notice. You should check your PAYE code and what tax your pension payer is taking off your income.

A PAYE Notice of Coding also known as a form P2 is a letter sent by HMRC that gives you your tax code. You can pay your Self Assessment bill through your PAYE tax code as long as all these apply. A total of 2000 interviews were achieved.

A PAYE notice of coding is also known as a form P2 and is usually posted at the start of each tax year by HMRC. The most common tax. P60 your annual tax.

HM Revenue and Customs HMRC will send you an email alert if one of your employees tax codes changes. Also called a P2 its an official letter breaking down your tax code and why you have the code you do. Your tax code is used by your employer or pension provider to work out how much Income Tax to take from your pay or pension.

Through your tax code. The P2 is a personalised communication telling the customer what makes up their code s and provides an. This explains your PAYE codes.

You will generally receive a paper coding notice also known as a form P2 through the post. Does anyone know if you can get a copy of your PAYE coding notice. Go to Self Assessment Go to More Self Assessment Details On the menu on the left open View PAYE coding notices Select year etc.

There are several places you can find your tax code. You should double-check that the tax code stated on your PAYE Notice of Coding is correct and that all of the information on your notice of coding is accurate. The notice of coding has an explanation of how your tax code has been made up by HMRC and will include any job expenses for example professional fees flat rate expenses.

If you need to tell HMRC about a change in someone elses income for example because youre their accountant fill in a PAYE Coding Notice query form. Im not too clued up and the leaflet it says should have been enclosed isnt. In early April you should receive a letter from HMRC with something called your Notice of Coding.

If you think your tax code is incorrect you should contact HMRC on 0300 200 3300. After you report your change HMRC will. PAYE Coding Notice Form P2 you and your employer get this notice of coding from HMRC in the mail every March.

It also tells you the reason why HMRC gave you that tax code. If your employer doesnt have a code for you they will deduct tax at the full rate of 20. You can use the facility called Check your income tax for the current year in your Personal Tax Account.

In the post today I received my PAYE coding notice for 0506. More detailed instructions to find your PAYE Coding notices. A coding notice tells your employer how many allowances you have so they can work out the tax to deduct from your wages or pension each time you are paid.

There are some cases where HMRC are not obliged to issue a coding notice in hard copy but you can still ask them for one you will always be able to see your current coding notice in your Personal Tax Account. Fill in your return. How they are used and calculated.

You can then explore your tax-free amount and have individual entries changed. Its important to make sure that you have a code for an employer and that the details on the coding notice are accurate and up to date. These respondents were contacted via the LSR online access panel2.

Anyway details are as follows-Tax allowances. What is PAYE notice of coding. Your PAYE code tells your employers andor pension providers how much tax to take from your wages or pension every pay day.

Our records show that your 2012-13 PAYE Notice of Coding includes an adjustment for tax underpaid. I have reached Section 4 Fill in Your Return - and want to know how I view my PAYE notice of coding online apparently you can do this but I cant find anywhere on HOW I do this. Testing of P2 Tax Coding Notice Communication amongst PAYE Customers 5 Method Data and Tools Used Sample An online survey was conducted with members of the general public who are PAYE1 Pay As You Earn customers.

HMRC they can be contacted by phone twitter or logging into your personal tax account httpswwwgovuktax-codesupdating-tax-code Employer Pension Provider as they will be calculating the tax due and making payments through the PAYE system they will be able to confirm to you the code that they are using and what payments are due to be made. In the process of moving Ive misplaced mine and wondered if the tax offices will. You can contact HMRC by phone or letter using the contact details on GOVUK.

You already pay tax through PAYE. P2 notice of coding. Your code takes into account any expenses you have.

Payslips weekly or monthly from your employer. I intend calling the IR tomz but thought I could get some help from soemone on here. There is information for employees and pensioners on how to check your PAYE coding notice in the employment section.

Sign in to your govuk Tax account. If you think you are overpaying tax through PAYE in the current tax year then it is likely there is a problem with your tax codeIf you are still working or receiving a pension you should tell HMRC why you think you have paid too much before the end of the tax year. How do I get my coding notice changed.

Time To Check Your Tax Code Hmrc Tax Codes

Tax Code Basics Uk Tax Calculators

Can Someone Please Explain Moneysavingexpert Forum

No comments:

Post a Comment